New iMONITRAF! Factsheet on unitary pricing components for HGV

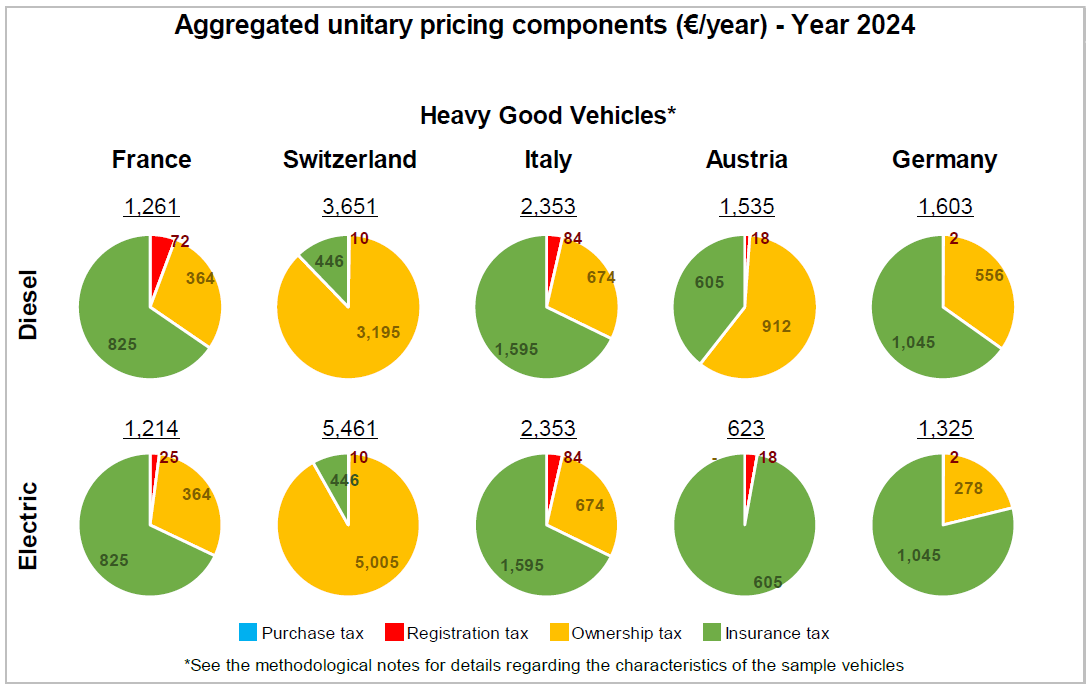

A new factsheet on unitary pricing components for heavy-goods vehicles (HGV) highlights how purchase and maintenance of HGV is taxed in the different Alpine countres – with a special focus on illustrating differences between diesel and electric propulsion systems. The different taxation elements like purchase, registration, ownership and insurance taxes shape the cost structure for HGV and thus determine the competitiveness of sustainable alternatives. The analysis demonstrates a need for harmonisation of pricing components among Alpine countries to send a clear message to transport hauliers for the decarbonisation vehicle fleets.

For diesel HGV, significant cost differences across countries can be observed: Switzerland has the highest tax burden for HGVs (€3,651/year), while France records the lowest costs (€1,261/year). Ownership and insurance taxes are the main drivers of these disparities.

The factsheet furthermore highlights additional policy measures that support the shift towards zero-emission HGV, presents selected measures implemented in the iMONITRAF! regions and summarizes some market dynamics.

With this factsheet, we launch a new series that puts the spotlight on the different iMONITRAF! indicators. Enjoy reading and stay up to date!

You will find this Factsheet here, previous Factsheets here and all our Publications here.